What is a Continuous Interest Rate Vs A Compounded Interest Rate

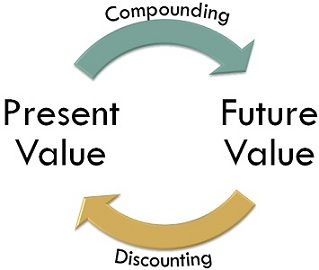

Time Value of Money says that the worth of a unit of money is going to be changed in future. Put simply, the value of one rupee today will be decreased in future. The whole concept is about the present value and future value of money. There are two methods used for ascertaining the worth of money at different points of time, namely, compounding and discounting. Compounding method is used to know the future value of present money. Conversely, discounting is a way to compute the present value of future money.

Time Value of Money says that the worth of a unit of money is going to be changed in future. Put simply, the value of one rupee today will be decreased in future. The whole concept is about the present value and future value of money. There are two methods used for ascertaining the worth of money at different points of time, namely, compounding and discounting. Compounding method is used to know the future value of present money. Conversely, discounting is a way to compute the present value of future money.

Compounding is helpful to know the future values, of the cash flow, at the end of the particular period, at a definite rate. Contrary to this, Discounting is used to determine the present value of the future cash flow, at a certain interest rate. Here, in this article, we've described the differences between compounding and discounting.

Content: Present Value Vs Future Value

- Comparison Chart

- Definition

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Compounding | Discounting |

|---|---|---|

| Meaning | The method used to determine the future value of present investment is known as Compounding. | The method used to determine the present value of future cash flows is known as Discounting. |

| Concept | If we invest some money today, what will be the amount we get at a future date. | What should be the amount we need to invest today, to get a specific amount in future. |

| Use of | Compound interest rate. | Discount rate |

| Known | Present Value | Future Value |

| Factor | Future Value Factor or Compounding Factor | Present Value Factor or Discounting Factor |

| Formula | FV = PV (1 + r)^n | PV = FV / (1 + r)^n |

Definition of Compounding

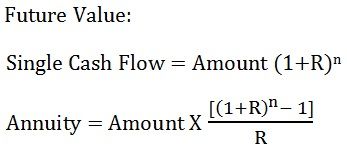

For understanding the concept of compounding, first of all, you need to know about the term future value. The money you invest today, will grow and earn interest on it, after a certain period, which will automatically change its value in future. So the worth of the investment in future is known as its Future Value. Compounding refers to the process of earning interest on both the principal amount, as well as accrued interest by reinvesting the entire amount to generate more interest.

Compounding is the method used in finding out the future value of the present investment. The future value can be computed by applying the compound interest formula which is as under:

Where n = number of years

Where n = number of years

R = Rate of return on investment.

Definition of Discounting

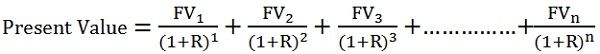

Discounting is the process of converting the future amount into its Present Value. Now you may wonder what is the present value? The current value of the given future value is known as Present Value. The discounting technique helps to ascertain the present value of future cash flows by applying a discount rate. The following formula is used to know the present value of a future sum:

Where 1,2,3,…..n represents future years

Where 1,2,3,…..n represents future years

FV = Cash flows generated in different years,

R = Discount Rate

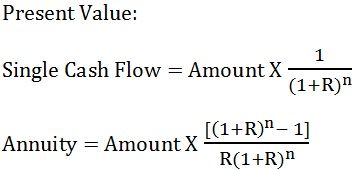

For calculating the present value of single cash flow and annuity the following formula should be used:

Where R = Discount Rate

Where R = Discount Rate

n = number of years

You can also use discount factor to arrive at the present value of a future amount by simply multiplying the factor with the future value. For this purpose, you need to refer the present value table.

Key Differences Between Compounding and Discounting

The following are the major differences between compounding and discounting:

- The method uses to know the future value of a present amount is known as Compounding. The process of determining the present value of the amount to be received in the future is known as Discounting.

- Compounding uses compound interest rates while discount rates are used in Discounting.

- Compounding of a present amount means what will we get tomorrow if we invest a certain sum today. Discounting of future sum means, what should we need to invest today to get the specified amount tomorrow.

- The future value factor table is referred to calculate the future value in case of compounding. Conversely, in discounting, present value can be computed with the help of a Present value factor table.

- In compounding, present value amount is already specified. On the other hand, the future value is given in the case of discounting.

Conclusion

Compounding and Discounting are simply opposite to each other. Compounding converts the present value into future value and discounting converts the future value into present value. So, we can say that if we reverse compounding it will become discounting. Compounding Factor table and Discounting Factor table is taken into consideration for the quick calculation of the two. In the table, you will find the factors, concerning different rates and periods. The factor is directly multiplied by the amount to arrive the present or future value.

Source: https://keydifferences.com/difference-between-compounding-and-discounting.html

0 Response to "What is a Continuous Interest Rate Vs A Compounded Interest Rate"

Postar um comentário